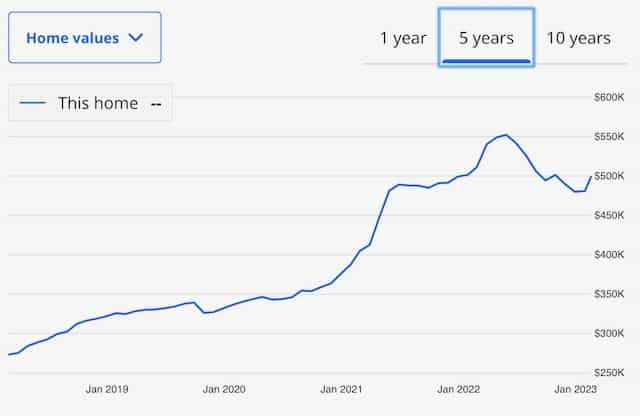

Wohw its been a crazy roller coaster for all us hasn’t it? We’re back to blogging. Last blog post we were heading into the scary times with Covid hitting and the market dropping. Who would have guessed what happened next. The feds dropped rates and the entire market blew up! The rates were in the 2%’s and every ran to buy a house. This created a huge housing shortage across the Nation and the sellers were getting top dollar plus for their houses. Soon sellers realized they can get pretty much asking price and then some so prices sky rocketed and buyers were competing with 20-30 offers. Those were crazy days. I remember me and Larry were doing open houses and the traffic was crazy we had entire neighborhoods blocked off with traffic lol it was insane. Blind offers and competing families were fighting for a house and buyers agents were getting very creative with their offers; it was crazy times. We enjoyed a lot of that too with 10 or so remodels that we did plus the listings we were doing. Larry went by the nickname “bidding war Larry” for quite some time lol. They were good times for sellers but hard for buyers. But with administration and inflation, things quickly changed.

Covid hit the economy pretty hard but the market took off so did Real Estate. Everyone was scrambling around trying to figure out a vaccine while the government supplemented households with printed income. The first stimulus injected a lot of money into the economy then came the second and third rounds; people were buying. The administration helped with unemployed and business loans that were printed by day and things got pretty hot. As time went by we had to get back to our normal daily grind and government needs their money back so here comes the inflation and rising rates. With the turn of the administration the rates sky rocketed grinding the real estate market to a slow down. We were really worried there when rates hit 7% and people were talking recession when winter months came in and showings stopped. This went on for several months as rates fluctuated and people were posting on social media of their hardships.

The rates rose (sky rocketed) pretty quickly and within months we went from 2-3% to 7%; wohw did this scare everyone. With winter setting in and the prices still high as can be, the real estate market ground to a halt. People were still asking ridiculous prices for the houses but things were different and the market shifted into the buyers favor. Sellers had to adjust and prices started coming down. We’ve seen the market shed a steady 3-5% per month for quite some time now and we kept asking where the bottom is.

What a wild ride! Right? Luckily the Utah market is resilient and people still need to find homes. As the new year started and with mortgage companies doing creative rate-buy-back programs people started buying again. The market regained some strength and were moving at a good pace.

What were focusing on now going forward are the market “Fed hikes” and how that’ll affect the real estate interest rates. We’re glad the houses are more in a realistic price range but really hoping the rates come down to a reasonable amount and we can all refinance and live in a happy world.

We love doing deals and getting our clients top dollar feel free to call or text us anytime thank you!

-Chris Kostya Barzin